The power sector in Southeast Asia is at a critical crossroads. As the region confronts the imperatives of climate change and the need for sustainable development, utility companies face an unprecedented challenge: transforming their operations in response to the '4Ds' - digitalisation, decentralisation, decarbonisation, and deregulation.

This transformation is not just about staying ; it's about survival in an increasingly complex and dynamic market. Industry analysts predict that within the next decade, every utility will need to overhaul its technology to meet the demands of the energy transition. But what does this transformation look like, and how can utilities, especially electricity retailers, best position themselves to thrive amidst this significant shift?

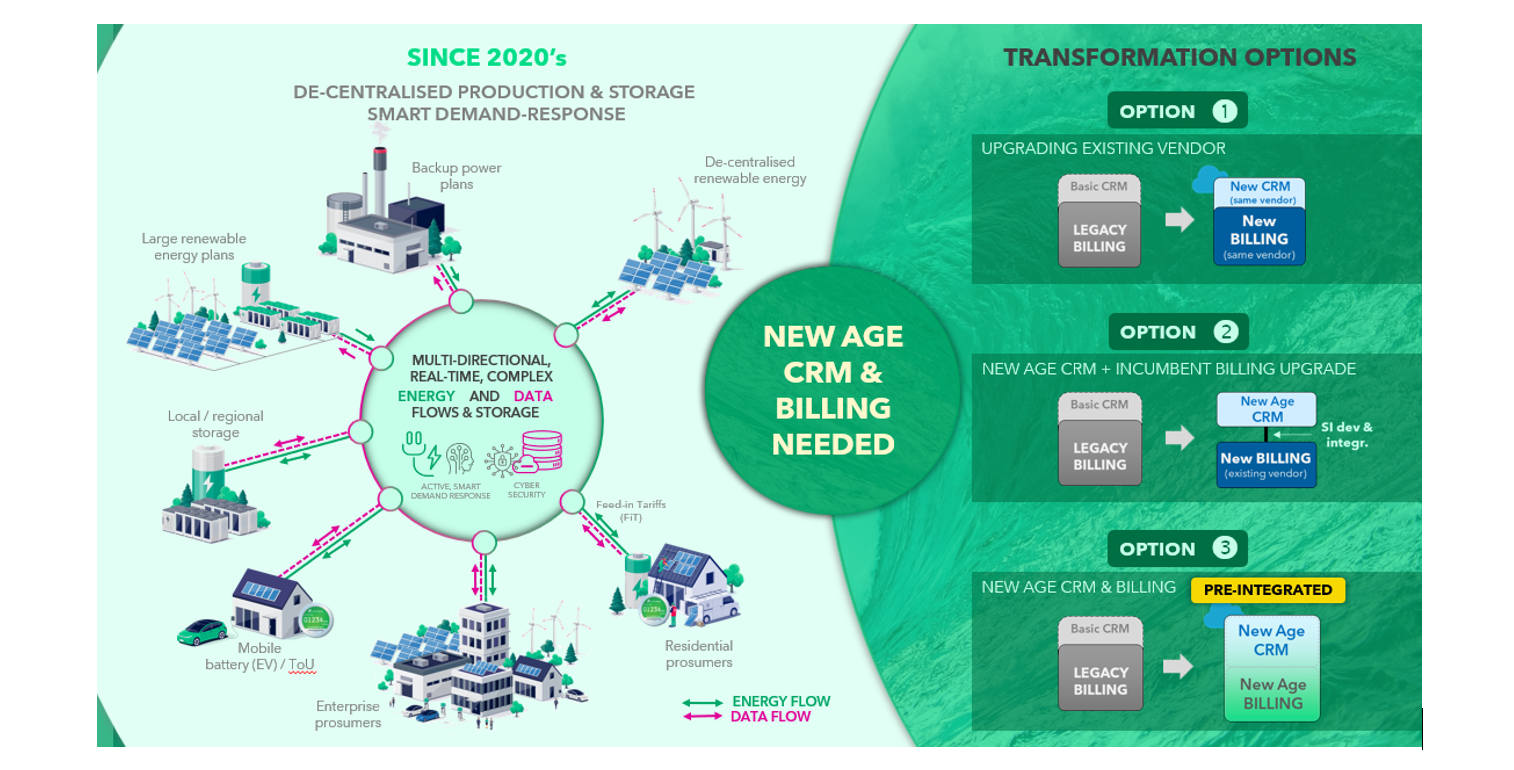

The Three Pathways of Technological Transformation

Technology adoption is central to every utility’s survival strategy. “Southeast Asia is increasingly embracing modern technologies to manage a decentralised grid” says Geoff Childs, Managing Director Asia at Gentrack. Childs notes that utilities, particularly retailers, typically face three options when considering updating their systems, each with its own set of advantages and pitfalls.

The Legacy Upgrade: This approach involves asking existing legacy vendors to upgrade current billing and CRM systems. While it's a familiar path, it often leads to unexpected complications and a heavy reliance on third-party consultancies. This model typically results in twice the cost and time as expected, with a low likelihood of achieving an effective operating model. Additionally, if often suffers from poor data synchronisation and integration.

The Hybrid Approach: This approach involves upgrading to a modern CRM system and integrating it with a new billing system. While it may seem logical, it carries significant risk. It is typically 3-4 times more expensive than anticipated (potentially costing between $100-400million), takes 2-4 times longer to implement, and results in divided SLA accountabilities. Moreover, there is often no joint solution roadmap or coordinated evolution between the CRM and the billing software.

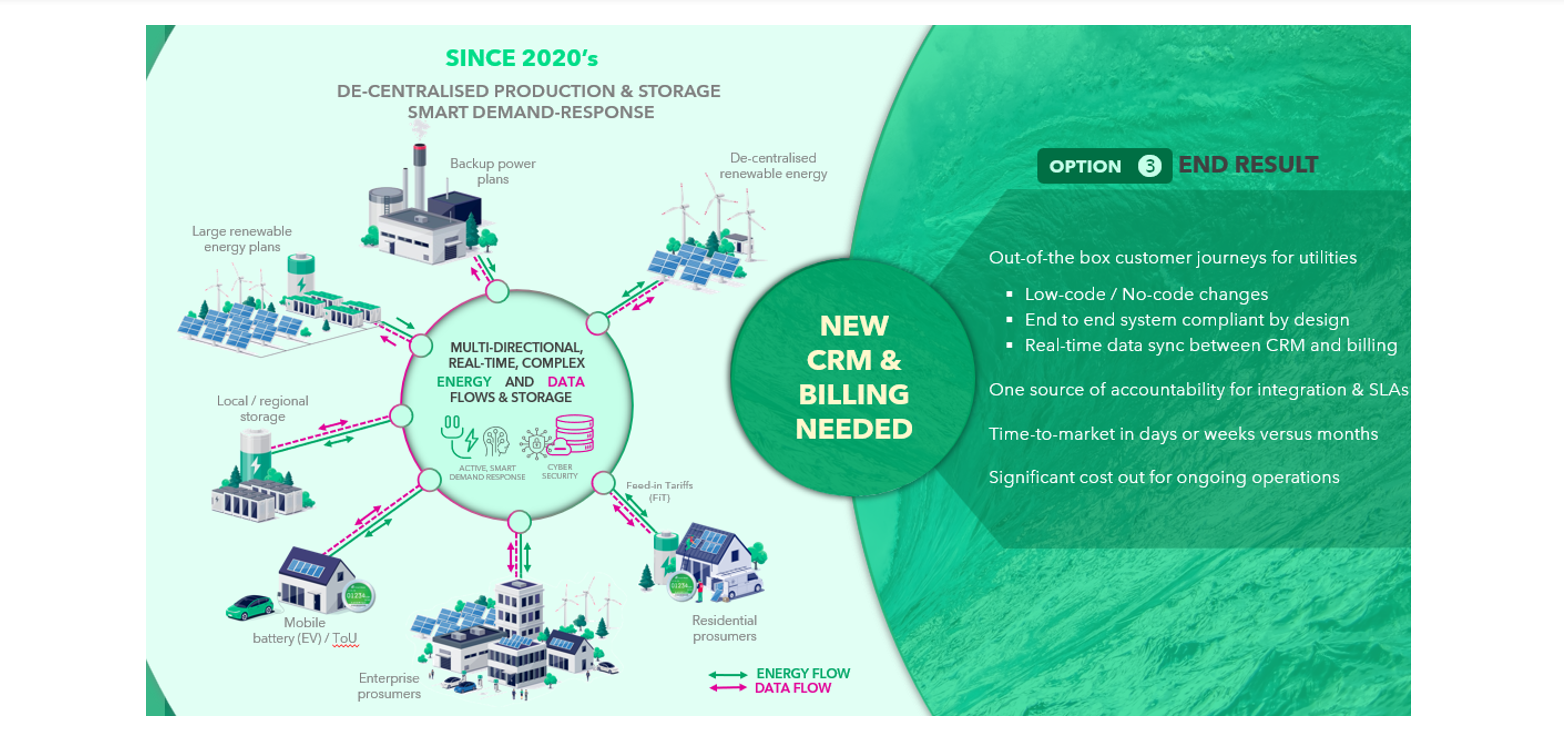

The Integrated Solution: This approach involves adopting a pre-integrated, modern CRM with new-age billing software. When properly scoped, this option typically stays on time and on budget. It enables real-time synchronisation between customer data in the CRM and the billing software, accelerates time-to-market, and typically enhances the customer experience by minimising errors.

The 4Ds in Southeast Asia

Technology is only part of the equation and the '4Ds' are profoundly reshaping the industry. Leveraging expertise from both advanced and emerging markets, Gentrack is ideally positioned to support utility retailers in Southeast Asia as they navigate these complexities and carve out their unique path through this transition.

Digitalisation is driving energy efficiency and fostering smarter consumer behaviour through advanced metering and data analytics. Decentralisation is paving the way for micro-generation and virtual power plants, which are essential for meeting 2050 Net Zero commitments. Decarbonisation efforts are gaining momentum, marked by a significant shift from coal to industrial-scale  renewable energy sources.

renewable energy sources.

Interestingly, deregulation is less of a focus in Southeast Asia compared to other regions. This strategic decision allows countries to concentrate on advancing the other three areas without the added complexities that deregulation might introduce at this stage.

Childs observes: "I feel very encouraged by the evolution of the power sector in Asia. Many countries in the region are making great leaps forward in the battle for climate change and their pursuit of net zero."

Empowering Consumers in the New Energy Landscape

As power becomes increasingly democratised, utility retailers must evolve from mere suppliers to partners in energy management. This shift involves leveraging smart meter data with AI and advanced analytics to understand consumption patterns, providing consumers with real-time data and actionable insights through digital applications, and offering innovative products and services.

By understanding when and how they consume energy, consumers can make more informed decisions, choose greener, more efficient energy sources, and contributing to a stable and sustainable grid.

However, an increasingly engaged consumer also becomes a more knowledgeable, and potentially challenging, consumer. As the shift towards renewables drives the prospect of deregulated markets, retailers will need modern technology capable of launching competitive propositions to attract and retain customers.

“We see utility companies offering a wide range of promotions, solar bundles, family plans, second home offers, short contract offers. They are partnering with airlines for mileage programs, providing personalised payment options, and offering energy trading apps, cashback deals, or energy roaming for charging EVs at various charging stations says Childs. ‘’To manage and calculate these customised promotions and energy trading options, you need a powerful, flexible low-code/no-code software.”

Balancing Efficiency and Revenue

At first glance, encouraging efficient energy use might seem at odds with a utility's need to generate revenue. However, forward-thinking companies are discovering innovative solutions. As Childs explains, "A reduction in an energy company's revenue from selling traditional electricity produced by large-scale coal power stations is inevitable. However, the combination of installing and servicing micro-generation assets into people's homes, along with managing the energy supply across the grid, will enhance both revenues and margin."

These solutions include offering installation and maintenance services for rooftop solar, batteries, and EV charging points. Some utilities are even exploring 'as-a-service' models, where micro-generation assets are installed at no upfront cost to consumers, with revenue generated by selling excess energy back to the grid.

Managing the Data Deluge

As digitalisation accelerates, utilities face the challenge of managing and deriving value from vast amounts of data. The solution lies in adopting modern cloud-based technologies capable of handling this data influx while enabling the integration of advanced customer experience technologies, AI, and machine learning.

Real-time processing and analysis of large data sets allow for better management of smart grids and micro-generation assets, leading to optimised operations and personalised customer engagement. This approach not only enhances operational efficiency but also improves customer satisfaction and loyalty.

Looking Ahead

The energy transition in Southeast Asia presents both challenges and opportunities for utility retailers. Those that successfully navigate this transformation will be well-positioned to thrive in the new energy landscape. By embracing technological innovation, focusing on customer empowerment, and developing new business models, utilities can play a pivotal role in shaping a more sustainable and resilient energy future for the region.

Sector evolution is vital, and regulatory frameworks must evolve to enable grid owners and retailers to support the energy transition. Collaboration between utilities, technology providers, regulators, and consumers will be crucial. The path forward may be complex, but with the right strategies, partners, and technologies in place, Southeast Asia's power sector can flourish as a leader of the global energy transition.

Gentrack is a global technology leader, offering advanced billing and CRM solutions tailored to the needs of utility retailers.

________________

They are exhibiting at Enlit Asia, Kuala Lumpur this year. Visit them at booth AG01 from 8-10th of October to understand how the wealth of experience they bring to the region can help retailers adopt the technologies and practices that will lead to a more sustainable and resilient energy future.

For more info visit www.gentrack.com